You don't have to be MrBeast, you can also earn money!

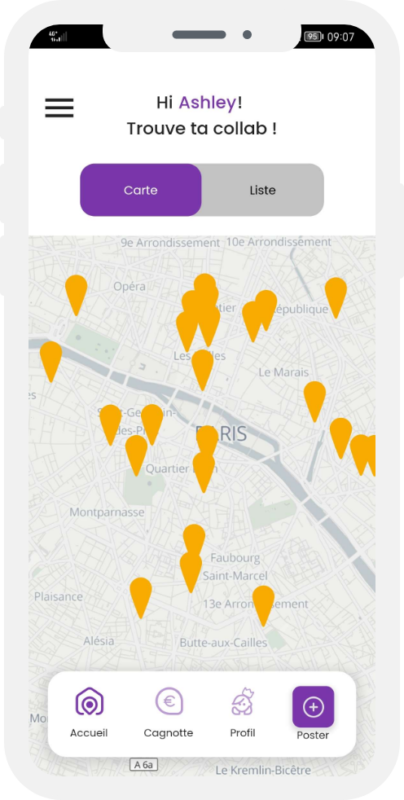

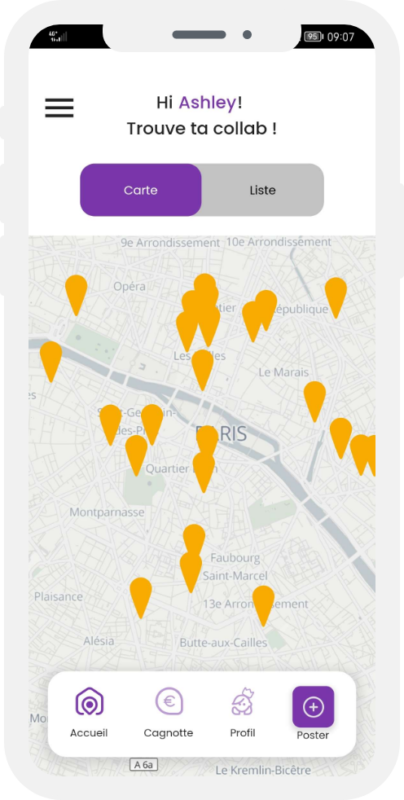

Participate in collabs near you

From now on, find ultra-localized campaigns: who better than you to tell us about the pizza place down the street or the new hairdresser in the neighborhood!

Our services

Local Collab

Enjoy a unique dining and shopping experience in your neighborhood. Share it on your social media and get paid.

Social Media Collab

Find the campaigns you like among the hundreds available! Get paid directly, without having to wait for products and test a service that doesn't suit you!

Shop and share

Receive a notification when you pass a Shop and Share chain store. Share your experience and your purchases on your social media to receive cashback!

Partner brands

Read our testimonials

Any questions?

Yes, Skwad registration is totally free.

All you have to do is install the Skwad application on the stores. Registration is done via your telephone number, just follow the instructions.

Yes, you can register even if you’re a minor.

You can choose to donate your revenues to a charity, or your revenues will be blocked on our platform until you turn 18.

However, if you wish to claim your revenues, you can do so under the responsibility of your legal representative.

You must provide Skwad with :

- photocopy of your legal representative’s identity card

- proof of your affiliation (family record book, etc.)

- a letter from your legal guardian requesting recovery of your revenues in your name

- your authorization for your legal representative to collect your revenues on your behalf.

- a tax receipt for the amount of your revenues to be reclaimed

Documents should be sent by email to: [email protected]

Skwad focuses on quality, not quantity. If you’re a specialist in your field and have very few followers, Skwad knows that your influence on them is important.

Yes, subscribing to another platform doesn’t prevent you from subscribing to Skwad and taking part in the collabs of your choice.

Yes, of course! You’ll be able to issue a tax receipt for the amount of your revenues (maximum $3,000 per year). You can also choose to donate your revenues to a charity. If you would like to receive your payment, you will need to issue an invoice in the name of the entity of your choice, or a tax receipt.